Marketing strategies for every grower

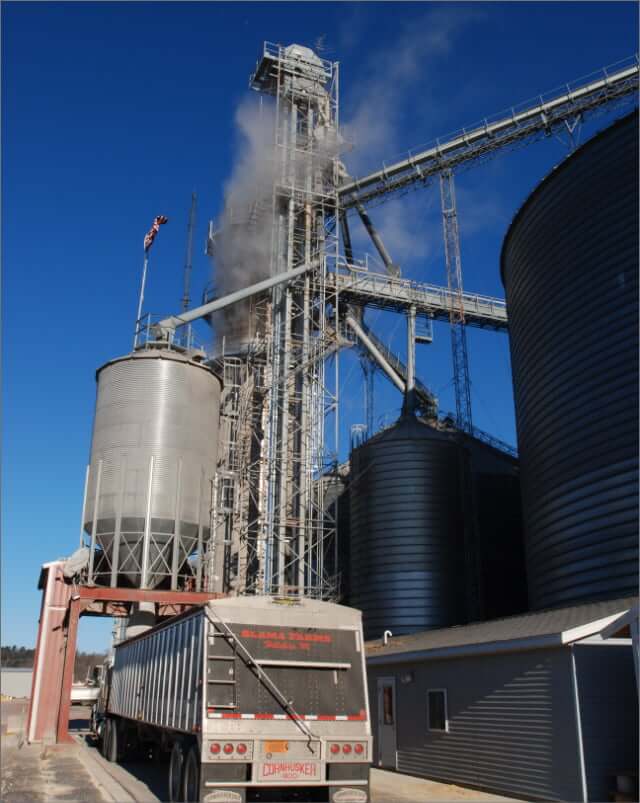

United Cooperative has gone to great lengths to make sure our grain receiving facilities are in the right locations for the majority of our member-owners. We keep our handling and storage equipment clean and in good working order to minimize hiccups during the critical fall harvest season, and offer extended grain delivery hours and extra help to keep our local harvest rolling.

For grain customers who use forward-pricing strategies, we can help you with your marketing plans and order placement, or execute orders and deliveries from your outside marketing firm. Our goal is to work with you in any capacity that makes the most sense for your operation. Click below for contracting options or to find a location near you.

Grain News

Letter from the CEO

Marquis and United Cooperative announce the sale of Marquis’ Necedah, Wisconsin, Ethanol facility to United Cooperative

Budgeting with Low Grain Prices

Harvesting Success Amidst Logistical Challenges: United Cooperative's Crop Insights and Expansion Plans

Contract Options

All purchase contracts have only standard drying and shrink policies applied and no storage fees.

Grain ownership is transferred immediately upon delivery to United Cooperative.

All contracts will be confirmed in writing that must be signed and returned to United Cooperative.

Used to lock in a price for a specific quantity, future delivery period, and location.

| Advantages | Disadvantages |

|

|

Bushels are sold (specific quantity, delivery period, location) with only the basis established. The producer can set the futures at any time prior to the first notice day for the contracted futures month (or it will be automatically set at noon).

| Advantages | Disadvantages |

|

|

Bushels are sold (specific quantity, delivery period, location) with only the futures price established. The producer must set the basis prior to or automatically at delivery

| Advantages | Disadvantages |

| Allows producer to lock in a futures and eliminate downward CBOT risk Still have opportunity to capture basis improvements | Can not take advantage CBOT futures price increases Risk basis changes $.05 services fee to establish the contract |

Bushels are sold (specific quantity in 5000 bu. increments, delivery period, location) as a cash sales with the cost of an option and service fee deducted.

| Advantages | Disadvantages |

|

|

Bushels are sold (specific quantity, harvest delivery, location) with the futures price to be determined based on a 22 week average. The basis is set by the producer at any time prior to or automatically at delivery. Click here for more information.

*Sign up deadline is January 31st, 2023.

| Advantages | Disadvantages |

|

|

United Cooperative participates in Wisconsin’s Agricultural Producer Security Program. If we fail to pay you for grain when payment is due, you may file a claim under this program. The program may provide some compensation. However,our “estimated default exposure” exceeds program coverage, and we have not filed security to cover the difference, so compensation may cover only a portion of your loss. For more information, you may contact the Wisconsin Department of Agriculture, Trade and Consumer Protection, 2811 Agriculture Drive, P.O.Box8911, Madison, WI 53708-8911 (phone 608/224-4998).

Delivery Options

Delivery Procedures

- Have tarps rolled open before proceeding to the scale or probe.

- Driver must know/inform scale operator of the account/name and application method to which the load should be applied. Prior to leaving, driver should review the ticket for accuracy and immediately have corrections made, if necessary.

- Please notify United Cooperative prior to delivery if you wish to have payment held/deferred.

Contract Grain: Grain delivered will be applied to any contracts first, starting with the oldest contract written. No early delivery of contract grain is allowed unless prior approval has been made. Grain balances above contract amounts have the following choices for application:

Cash/Spot: The bushels designated will be sold at the current market price (Subject to change during CBOT trading hours). Contact a buyer if you wish to have your grain spotted upon delivery.

7-Day Hold: There is a 7-day (calendar days) hold period for which grain can be delivered without storage charges accruing within the 7 days. Grain that is not sold within 7 days will be put into storage, and the storage start date reverts to the date of delivery. The 7-day hold applies to each load delivered.

Storage (Open Storage): Grain designated for storage will be assessed the applicable storage fees, including minimums and may have additional drying & shrink.

Grain Bank: Grain designated for grain bank is for feed purposes with applicable storage fees and may have additional drying & shrink.

Grain Discounts

Corn Discount Schedule - updated 10/5/2023

Soybean Discount Schedule - updated 9/20/2023

Wheat Discount Schedule - updated 7/11/2023

Grain Locations

Grain Team

Getting Started

The first step in selling grain at United Cooperative is filling out a brief membership or credit application.

Our Grain ACH Form allows you to receive automatic deposits of grain settlements. The direct deposit is typically seen within 24-48 hours of payment. To set up automatic deposits, download and complete the Grain ACH Form.